Dying intestate means that you have died without a Will.

I’m not sure that anybody plans to die without a Will. After all, most people don’t plan to die. But it happens. In fact, the vast majority of Canadian adults do not have a Will in place, and most of these people think that they will probably have plenty of opportunities to write one at some time in the future.

Dying intestate…who does that?

Amy Winehouse, Barry White, Jimi Hendrix, Sonny Bono and Bob Marley would make a terrific band. However, what brings them together in this article is that they all suffered the ignominy of dying intestate.

But you don’t have to be young with a rock and roll lifestyle to end up dying without a Will. Roman Blum was 97 years old with an estate valued at $40M, he died without a Will and and incredibly with no heirs. His entire fortune in this case, was destined for the government coffers.

None of his friends know why he never wrote a will. Those close to him say it may have been superstition or a refusal to contemplate his own mortality. He may also have been unwilling to share the full details of his estate with a lawyer

We are all left dismayed that these people could die without a Will, while secretly knowing that we haven’t taken care of our own affairs. How can this be?

There was a time when writing a Will was considered a major investment – a thousand dollar purchase that would be made once a lifetime, so it needed to be right, future-proof and have the longevity to see you through to your dying days. The best way to support this notion was to write one much later on in life, hopefully a year or so before you died.

Fortunately, I don’t need a Will yet

There are a few problems with this “plan”. The most obvious being that you don’t know when you are going to die. But leaving the writing of your Will until you are close to dying actually increases the chances of the Will being challenged. You may not have “testamentary capacity”, or be of “sound mind”. And once your mental capacity is in question, it is too late to prepare any of your estate planning documents.

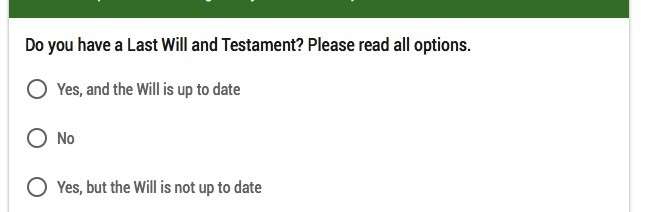

You should write your Will now, whatever age you may be. And then update that Will throughout your lifetime as circumstances change.

There was an article just last week of a deathbed Will that was overturned, but it happens all the time. People who are in the throws of dying are not best placed to be preparing their estate planning documents.

If you are reading this having not written your Will, here are a few important take-aways from this article:

- A spouse does not automatically inherit all of your property. In fact, in most Canadian Provinces if you have a spouse and children, the chances are, your spouse will not be your sole beneficiary.

- Your children will inherit, but nobody, including your spouse can decide how everything will be divided between the children. And they will receive their inheritance at 18 or 19 depending on the Province. There is nothing that anybody can do about this, including your spouse.

- The courts will appoint somebody to administer your estate and take care of your affairs. Your spouse or family members do not make that appointment, the courts do.

- Your family do not decide how your possessions will be distributed, the court appointed administrator will. And this may include selling off items that you wanted to be kept in the family.

- Nobody who is more deserving can receive more. In fact, there is no discretion involved at all. Your estate is distributed according to the established formula.

- The distribution of everything will be delayed, as your loved ones will have to wait for their time with the courts.

- You are more likely to see a free-for-all over your possessions. With nothing written to the contrary, people will start helping themselves in the confusion. Trust me, it happens.

So let’s look in a little more detail about the process when a person ends up dying intestate.

1. You have left your grieving family completely confused

Your family will be grieving, some may be distraught.

Copyright: akz / 123RF Stock Photo

Unless you made a bold declaration that you are not going to prepare a Will, and you are choosing to live your life without a Will in place, the assumption will be that you have written a Will and kept it somewhere safe. We witness this every single day in our support organization. We received a call this morning.

My father died yesterday, but we don’t know if he had a Will. Now everybody is going through his things in his house trying to find it, and the house is chaos. I’m sure people are just helping themselves to everything

This estate is in a horrible limbo. Nobody is in a position to say “I have the Will, I have been appointed the Executor, and my responsibility is to secure the assets of the estate. I am now changing the locks on the house and will start probate proceedings.”

It is interesting that people express their frustration and dismay that a loved one could have died without a Will. But it turns out that these people invariably have no estate planning documents of their own.

Your family will phone around local law offices, they will phone online services like ours, they will do everything they can to track down a Will that doesn’t exist. It’s a frustrating activity, undertaken at an emotionally raw time.

After many days of a fruitless search, they will likely go to the attorney general‘s website for your Province and read about what they are supposed to do. In Ontario, the website explains

If you have a Will; the probate court approves the appointment of the Executor “You are considered the deceased person’s personal representative, and will carry out their wishes as stated in the will.”

The Attorney General website goes onto explain

If you do not have a Will: “Without a will, an estate is distributed according to the law. This can be a complex process. If you are in this situation, you might want to contact a lawyer.”

The contrast could not be more stark; with a Will, straightforward, without a Will, complex and expensive.

2. Dying intestate means you didn’t name an Executor

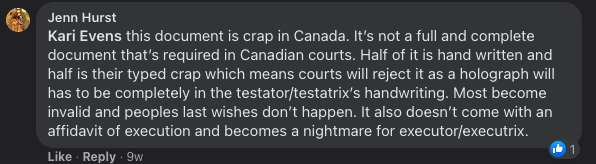

There is a great deal of misinformation written about the probate process, partly because people mis-apply references from the United States to situations in Canada. It is a very different legal system.

Probate in Canada is simply the acceptance of your Will as your Last Will and Testament, and the appointment of your Executor as your personal representative. When you die, loved ones cannot just show up at a bank and ask for your money. They cannot even show up with a Will; the bank has no way of knowing whether the document in their hands is the valid Last Will and Testament, whether it was superseded by another Will, or whether it was written or signed by the testator. They do not have the skills, or the legal authority to make that determination.

The courts have to determine the authenticity of a Will, and accept the appointment of Executor. They will in turn give your Executor a “grant of administration” (the terminology varies slightly from Province to Province) but in essence your Executor will receive a court issued document that appoints your Executor and gives them the authority to gather your assets and distribute them according to the instructions in the Will.

Is it this Grant of Administration that will be accepted by the financial institutions.

But without a Will, there may be no obvious candidate for this appointment. The general rule is that your closest relative has the right to be appointed as your personal representative. They are appointed by applying to the court for a Certificate of Appointment of Estate Trustee Without a Will. This gives authority to the personal representative to manage and distribute the estate of the deceased. But you have to hope that there are no conflicting claims to take on this role.

Incidentally, this person also has the final say in your funeral arrangements. Another area fraught with emotional family disagreements.

3. Your loved ones cannot get hold of your assets

When somebody ends up dying intestate, everything is frozen. There may be creditors who have a claim on an estate and they will always be paid first (after taxes and funeral expenses).

Copyright: tawhy / 123RF Stock Photo

Your loved ones cannot approach a bank and ask for the contents of your bank account even if it is to pay funeral expenses. A bank will not release funds without appropriate documentation from a court.

Until your loved ones have gone through all the steps explained above, your entire estate will be frozen.

4. You haven’t decided how your estate will be distributed

You may have made the decision that it’s obvious how your assets will be distributed; it will all go to your spouse, or it will all go to your children.

In fact, the courts have decided how your estate will be distributed.

[tweetthis twitter_handles=”LegalWills” display_mode=”box” remove_url=”true”]The most dangerous misconception of #dyingwithoutaWill is that if you are married, your spouse will receive everything.[/tweetthis]This is almost always not going to happen.

In fact, when a person is dying intestate, each Province has its own rules as to who gets what. It depends on the structure of your family and the size of your estate. Just one note of caution

[tweetthis twitter_handles=”LegalWills” display_mode=”box” remove_url=”true”]If you are common-law, or separated, you need a Will. Without one, your estate distribution will be a shock to you.[/tweetthis]Let us take a couple of examples. You are married, you have two young children, aged 5 and 3. You die in Nova Scotia with an estate worth $500,000. Your spouse would receive $200,000, your 5 year old will receive $150,000, your 3 year old will receive $150,000, which will be deposited in their bank account on their 19th birthday. If you were living common-law with your partner, then this person would receive absolutely nothing. Your two toddlers would receive $250k each, held in trust.

What if you had separated from your spouse, and were now living with a new partner. You had lived with this new partner for a number of years, but never formalized that divorce paperwork. Then if you opt for dying intestate, your new partner would be receiving nothing. Your estranged spouse would be sharing your estate with your children. Imagine what would happen to the family home in this situation!

There are countless other surprising scenarios that can be avoided by taking the 20 minutes to prepare your Will.

5. You missed the chance to give to charity

Let’s move beyond avoiding the catastrophic and think about the good things that a Will can do for you.

A Will is your opportunity to recognize the people or organizations who have made a difference in your life. This can be your local church, community group, school, or even a special friend. Is there a person who has impacted your life in a special way? your Will is a final opportunity to show some appreciation to that person.

If you are dying intestate, no charitable organization will receive any part of your estate no matter what. No friend will receive any money or any possession from your estate.

Maybe a friend always admired your signed Wayne Gretzky jersey, your Steinway piano or your Rolex watch. Maybe you have spent your life helping out at your local mission; think how many “come out of the cold” hot meals a percentage of your estate would be able to provide. Or maybe you haven’t been particularly charitable in your lifetime, but have always wanted to do more.

In your Will you can leave specific items, sums of money or percentages of your estate. If you leave 5 percent of your estate to a local community group it can make a massive difference.

Of course, if you are dying intestate, you have missed that opportunity.

6. You didn’t name a guardian for your children or set up trusts for minor beneficiares

If you have young children, maybe the most important part of your will is naming someone to be their guardian, in case both you and your children’s other parent die.

If something were to happen to both parents, the hope is that people will come forward and apply for the guardianship of the children. A judge will make the appointment.

Of course, the judge will know nothing about your family history, will not understand the family dynamics, shared values and interpersonal dynamics. The judge will appoint the person you name in your Will, unless there are serious reasons not to (for example, if the person refuses the appointment, is serving time in jail or cannot be found!). If you end up dying intestate however, and haven’t named a guardian, the judge will have to choose someone without your input.

You have a choice. You can either carefully consider appointing a guardian for your children, or you can leave the appointment up to a complete stranger. Some of the considerations that could factor into your appointment that the judge may overlook include;

– Moral or religious background

– Philosophy with respect to raising children including discipling and rewards

– Health and wellness

– Approach to education

– Political views

– Work/life balance

– Family dynamics

It is a very nuanced decision that is not easy even when you have intimate knowledge of your family. A judge will not be in the best position to make this appointment for you.

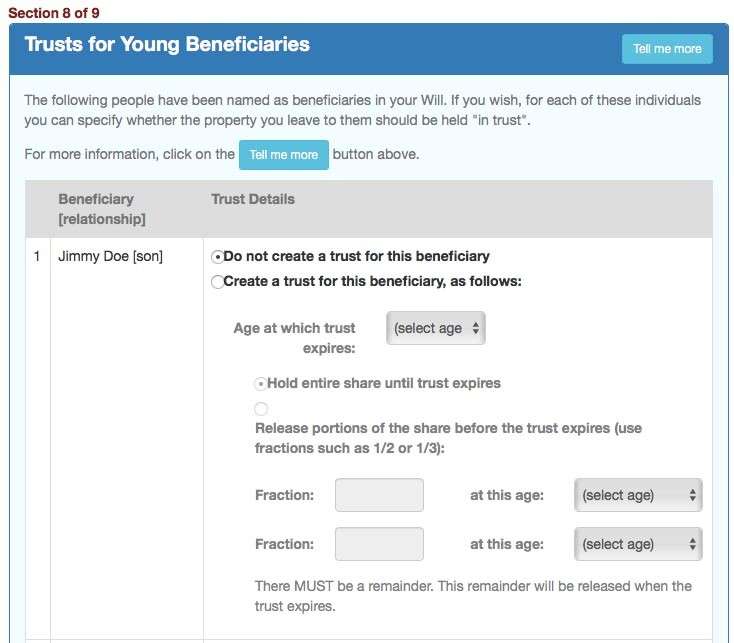

And there there is the matter of minor trusts. If you do not prepare a Will, your children will receive their inheritance when they reach the age of majority. This is 18 or 19 depending on the Province. For most children, this is too young to receive a major inheritance.

Copyright: NejroN / 123RF Stock Photo

When you prepare your Will, you can set up a trust for a young beneficiary that determines when they will receive their inheritance. You can even split this so that they may receive a third at 21, a third at 25 and the remainder at 30.

So why would you opt for dying intestate?

Writing a Will takes about 20 minutes and costs less than $40.

And if you have read this far you will have realized that the one person who is not impacted by your decision is you.

[tweetthis display_mode=”box”]Your choice to die intestate does not affect you. But it is catastrophic for your family and loved ones.[/tweetthis]The people impacted by your decision to die intestate are your family, your loved ones, charities, and your children.

A note on storing your Will

On a daily basis we hear from people who can’t find a loved one’s Will. Somebody took the time to think through their estate planning needs. They took the time to prepare a Will either through a lawyer, or using an online service like ours. They thought about the distribution of their estate, they carefully considered guardians for their children and set up trusts for the minor beneficiaries.

Unfortunately, this counted for nothing because nobody could find their Will.

[tweetthis twitter_handles=”LegalWills” remove_url=”true”]Writing a Will and hiding it so well that nobody can find it, has the exact same end result as #dyingwithoutaWill [/tweetthis]We recommend that if you have prepared your Will, you store it in a safe place that it known and accessible to your Executor. Do not hide it, or keep it a secret.

Write your Will today, and then give it to your Executor in a sealed envelope for safe keeping.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022