We live in unprecedented times. We have a COVID-19 global pandemic. People are being told to self-isolate. Others are being placed in quarantine.

It’s a worrying situation that does not appear to be abating.

It may be time to pause and to think about which documents you should have in place. If COVID-19 goes away, and we all hope it does, these documents are still important, and will last you for the rest of your life. Hopefully that will be another 50 years or more. The documents may need to be updated as your circumstances change, but it is important to have them in place.

In this article we will describe a complete list of documents that you should put in place. We will explain how to create each one, how much it costs, and the legal formalities for each.

Table of Contents

The Last Will and Testament

What is it?

This is our specialty. It only comes into effect after you have died and performs two important functions:

- It makes key appointments for after you have passed away, including an Executor (the person with the responsibility to gather your assets and distribute them according to your instructions) and a Guardian for your children if they are still minors.

- It allows you to describe the distribution of your “estate” (everything that you own). This includes bank accounts, investments, real estate, possessions, family heirlooms, and even “digital assets”. You can simply leave your “entire estate” to a person or to be shared between people. Or you can leave “specific bequests” like “$5,000 to my niece Sarah Jones” or “my signed Wayne Gretzky jersey to my nephew Bobby Smith”. It also allows you to leave charitable bequests to meaningful causes.

How do I get one?

Generally speaking, there are three ways to prepare a Last Will and Testament.

- You can write it yourself using a blank piece of paper, or some kind of blank form Will kit. Just this week a judge declared that a Will written on a napkin in McDonalds was acceptable as a legal Last Will and Testament. But a Will written this way is likely to be a very poorly written Will. Unless you have legal training, it is almost impossible to draft a solid legal document using a sheet of paper or a blank Will kit. The problem is, you won’t know how bad the document is. It’s your loved ones who will have to work with it.

- You can work with an estate planning lawyer. You set up an appointment and explain to the lawyer how you want to distribute your assets. Hopefully they will give you some legal advice on what can and cannot be done in your Will, and perhaps even some advice in how to structure your estate to reduce probate fees. They will then prepare your Will, and you will return at a later date to sign the document.

- A convenient and affordable middle ground between the cheap, ineffective Will kit, and the expensive, inconvenient estate planning lawyer is an online interactive Will writing service like the one at LegalWills.ca. This type of service guides you through the process of preparing your Will by asking you a series of questions. At the end, your Will is compiled. You can then download and print it, ready for signing. The nice thing about these services is that it is also very easy to update documents when your circumstances change.

How much does it cost?

This is one of the mysteries of Will writing. A blank form Will kit could in some cases be absolutely free – but it wouldn’t give you a very good Will. Some estate planning lawyers will charge over a thousand dollars for a Will. We wrote a whole article on the cost of a Will and why a Will can sometimes cost nothing, and sometimes cost a thousand dollars.

An online Will writing service generally allows you to prepare a Will from about $40 to $100. LegalWills.ca happens to be one of the most affordable at $39.95.

An estate planning lawyer typically charges about $400-$600 for a Will, but will often combine this with some of the other documents described below in order to create a complete “estate plan”.

What do I do with it once I’ve made it?

If you are preparing the document yourself, either using a blank form kit, or using an online interactive service, you must have the document typed on paper. It must then be signed in the presence of two adult witnesses who have nothing to gain from the document. A witness cannot receive anything from a Will. In most provinces, this extends to the spouse of a witness. Otherwise, friends, neighbours, and co-workers can all serve as witnesses to the signing of the document.

If you prepare your Will with an estate planning lawyer, they will usually take care of this for you and provide you with a couple of witnesses from the office.

The document should then be stored in a place that is known and accessible to your Executor. Some people just give the document to their Executor for safe keeping. Do not hide the Will.

After you have passed away, the Executor will file the document with the probate courts. The document does not have to be stamped or registered the entire time you are alive.

Financial Power of Attorney

What is it?

A financial Power of Attorney gives somebody else the authority to handle your finances on your behalf. Usually this is set up when you are competent, to come into effect if you ever lose capacity. Therefore, if you were ever in a coma, or you were diagnosed with dementia, or became otherwise gravely ill, then somebody could pay your bills, work with your investments, file your taxes, or even sell your house.

There are various types of financial Power of Attorney. It can be specific (where you allow, for example, somebody to sell your car while you are out of the country), or general (where somebody has complete control of your finances). It can be “enduring” or “durable” meaning that it’s still in place even if you lose capacity, or “springing” meaning that it would only come into effect if you were to ever to lose capacity.

The strange thing about a financial Power of Attorney (PoA) is that the PoA may never end up being used; you may never be incapacitated or diagnosed as incompetent. This is unlike a Will, which is definitely going to be used at some point. However, if you are ever in this situation, it is an invaluable document to have, and of course it’s too late to prepare one once you lose capacity. Usually a financial PoA is created to cover the “just in case” scenario.

One other thing to note is that given the power of this document, and the triggers for coming into effect (after you lose capacity), it can sadly make people vulnerable. There are countless stories of seniors signing over a financial Power of Attorney to an unscrupulous caregiver. So be very careful when creating this document to appoint somebody you really trust.

How do I get one?

A financial Power of Attorney is usually created as part of a complete “estate plan”, so if you are working with an estate planning lawyer to prepare your Last Will and Testament, they will usually encourage you to prepare a financial Power of Attorney at the same time.

If you only need the financial Power of Attorney, somewhat like with the Will, you can download free forms from the internet. However, be very careful that these forms are specific to your province. Unlike a Will, which is quite similar across Canada, a financial Power of Attorney is dramatically different from BC to Alberta, from Ontario to Quebec. There is no such thing as a Canadian financial Power of Attorney, they are specific to each province.

Most online Will writing services, including the service at LegalWills.ca have a service for preparing the financial Power of Attorney. The document can be created in about ten minutes, directly online.

How much does it cost?

A financial Power of Attorney can be created for free from a downloaded form, or you can pay about $250-$400 to have one prepared by a lawyer. Be very careful that the free document is specific to your province and comes with enough instructions to make the document acceptable. The signing requirements for a financial Power of Attorney vary by province and are more complicated than a Will.

The financial Power of Attorney service at LegalWills.ca costs $29.95.

What do I do with it once I’ve made it?

The legal requirement across Canada for making a financial Power of Attorney legal, is that it must be signed in the presence of two witnesses.

One interesting exception is that in Manitoba, a witness must be one of:

- a person registered or qualified to be registered to solemnize marriages in Manitoba

- a judge, justice of the peace or magistrate in Manitoba

- a qualified medical practitioner in Manitoba

- a notary public for Manitoba

- a lawyer entitled to practice in Manitoba, or

- a member of the R.C.M.P. or a police officer in a municipal police force in Manitoba

However, the legal requirements for preparing the document are only going to get you so far. Some financial institutions have implemented their own internal requirements for a valid Power of Attorney. Notably, some banks require the document to be notarized before it can be accepted. This is done through a signed Affidavit. If you are preparing a Power of Attorney with specific financial institutions in mind, you should check their policies for accepting a signed Power of Attorney.

In addition, if you are buying or selling a house and working with the Land Titles department in your province, they will almost certainly require a notarized document.

At LegalWills.ca, we provide a downloadable “Affidavit of Execution” that your witnesses can sign in the presence of a Notary. We do not charge for this document. Depending on which province you are living in, a Notary can be found online for as little as $20.

Healthcare Power of Attorney

What is it?

There are a lot of different names for this document, and at LegalWills.ca, we combine two documents under our “Living Will” service. We wrote a separate article that tries to make sense of the different documents broadly described as a “Living Will” or “Advance Directive“.

Essentially, the Living Will is made up of two documents; the first one is your “Advance Directive” or “Medical Directive”. It allows you to express, ahead of time, the types of medical treatment you would wish to receive if you were ever in an irreversible, terminal condition. It includes things like whether you would want to be kept alive if you had no chance of recovery, whether you would want to be resuscitated, whether you would want pain relief even if it was to hasten your death. Without an Advance Directive, the attending medical team would be required to do everything they could to keep you alive. This document tells them what you would really want to happen.

Together with your Advance Directive is the appointment of a “substitute decision maker” (this is called something different in every province, including Healthcare Proxy, Healthcare Representative or Medical Power of Attorney). This is the naming of a single person to make medical decisions on your behalf if you are ever unable to speak for yourself.

Somewhat like the financial Power of Attorney, it is a document that may never end up being used – you may never be in a coma, but if you are, it is an extremely useful document to have in place. There are countless stories of family members who cannot agree on the correct course of action. In the US, the case of Terri Schiavo caused a huge spike in the writing of Living Wills, after the decision went all the way to the Supreme court. It was a spouse against parents case, deciding on the best way forward with a loved one who had no hope of recovery. Most people felt that there was a seven year delay in removing the feeding tube that was keeping her alive while the case went through every level of the courts, and eventually even landed on the President’s desk.

How do I get one?

The Healthcare Directive has to be accepted by the attending physicians and has to comply with your provincial laws. There is actually a rapidly changing legal framework for medically assisted suicide and the right to die, so any template that you use must be kept up-to-date and must reflect the most recent legislation in this area, for your province.

You can download free templates. However, if you are doing this, it is probably best to get the template from a healthcare institution like a hospital or hospice. They are more likely to have up-to-date templates available.

Estate planning lawyers can usually provide these documents as part of an estate planning package, but are unlikely to write only a “Living Will” without preparing a Last Will and Testament or Financial Power of Attorney.

Most online Will writing services, including LegalWills.ca, have interactive services for preparing these documents.

How much does it cost?

You may be able to find one at a local hospital or healthcare facility free of charge. Certainly, some nursing homes or hospices may have Advance Directive forms available to you. The advantage of sourcing the forms from a healthcare facility is that they are likely to be up-to-date and specific for your province.

Do not purchase these forms as a kit from sources like Amazon. A quick look shows one that is 18 years old (certainly out of date) and not specific to your province. This would likely not be accepted by attending physicians.

The Living Will service at LegalWills.ca is $19.95 and kept up-to-date. You can prepare your Advance Directive and name a Healthcare Representative in about 15 minutes with this service.

What do I do with it once I’ve made it?

To make your Living Will an acceptable document, it must be signed in the presence of two independent witnesses (your nominated Healthcare Representative cannot serve as a witness). Once it is signed and witnessed, your Healthcare Representative must know where it is stored, and have access to it when they need it. The best plan is to simply give it to your representative in a sealed envelope for safe-keeping.

Funeral wishes

What is it?

There is a common misconception that your funeral wishes should be written into your Will. There are a couple of reasons why this doesn’t make sense:

i. Your funeral wishes are not legally binding in Canada; they are simply an expression of your wishes. You would hope that your loved ones would honour and respect your wishes, but unlike with a Will, they are not legally bound to abide by your wishes.

ii. Furthermore, before your Will is accepted as a legal document, it must be approved by the courts through the “probate process”. The courts then officially appoint your Executor as the estate administrator and the contents of the Will are legally accepted as your wishes. By the time this process is complete, your funeral would likely have been completed.

There is no legal framework for your funeral wishes; it is simply an expression of your wishes. It can cover everything from the disposition of the body, to the general vibe of the service, E.g. do you want it to be celebratory or sombre?

The Funeral Wishes document serves at least one very important function. When your loved ones are working with the funeral home, in a vulnerable state shortly after your passing, it has been known for funeral service providers to suggest unnecessary “upsells”. We’ve even seen beautiful mahogany caskets with a lumbar support being offered! Most rational people would prefer to see their estate go to their loved ones rather than to be spent on a lavish funeral and a casket that will be incinerated.

By documenting your funeral wishes you can relieve a tremendous burden from your loved ones by giving them permission to be frugal. Or, on the other hand, explain to them that you do want to spend $50,000 on your funeral.

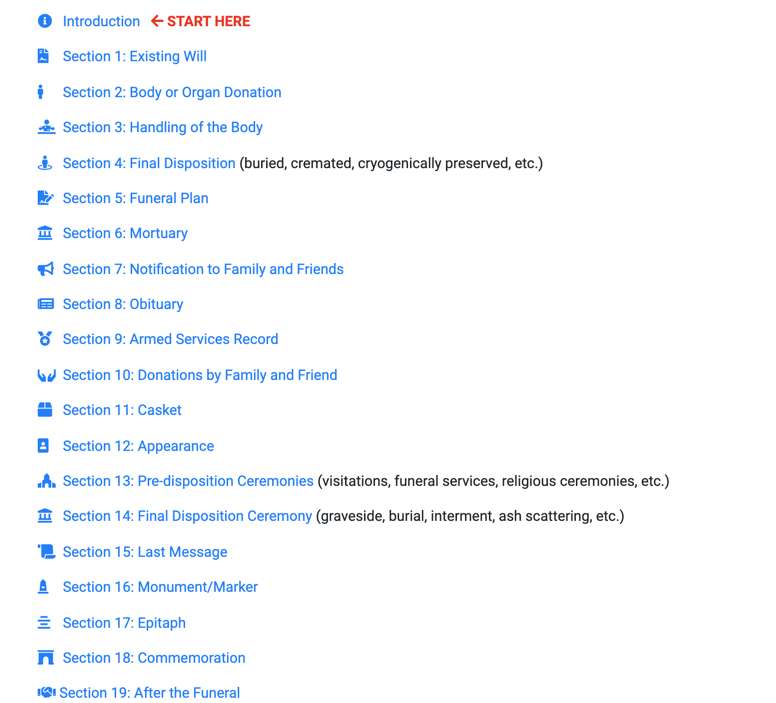

The subsections of the MyFuneral service at LegalWills.ca are shown here

How do I get one?

This is really a document that you can prepare yourself. It is not an official legal document and has no formal legal framework.

We do offer the MyFuneral service at LegalWills.ca. It works in exactly the same way as our estate planning services in that you are guided through a series of questions, with your final document being compiled based on the answers to these questions.

You may of course be able to find a template for expressing your funeral wishes at a funeral service provider.

How much does it cost?

The MyFuneral service at LegalWills.ca is $19.95. You do not have to use the Will service or any other paid service at LegalWills.ca to use the MyFuneral service. It’s there for you if you need it.

What do I do with it once I’ve made it?

There is no legal signing requirement for this document. You do not have to sign in the presence of witnesses. You simply need to sign the document yourself, and date it, just to ensure that everybody knows it is actually your true wishes.

Your funeral wishes need to be available to your family and loved ones. You can even talk to your family about some of the options that you have chosen. Make sure that the document is not hidden away because often decisions have to be made quite quickly.

It is probably best to store the document with your Will, or give the document to the Executor of your Will in the same sealed envelope (see “what to do with your Will” above).

Inventory of assets

What is it?

This is perhaps one of the most critical documents in your estate planning portfolio, yet it is the document most frequently overlooked.

When you prepare a Will, you typically describe the distribution of your “estate” to a beneficiary, or shared between beneficiaries. The nature of your estate changes between writing the Will and the Will coming into effect. You certainly don’t want to list all of your assets in your Will. You don’t know when your Will is going to come into effect, and your assets are likely to change over time. This would require you to update your Will every time you opened a new bank account or made a major purchase. Furthermore, once a Will is probated, it becomes a public document that everybody can read. You may not want details of all of your assets made public.

If a particular item has a specific beneficiary that is different to the main beneficiary of your estate, then yes, it must be included. For example, if everything it going to your son, except for a piece of art which is going to your nephew, then the piece of art has to be included in your Will.

It does make sense to list your assets in order to help your Executor administer the estate. They have to gather your assets and it is helpful to have the accounts documented so that they can be sure that nothing is forgotten; just not in the Will itself.

When the Executor has to gather up the assets, how will they know that they have found every account? How will they know when the job of finding the assets is complete? How can you be certain that nothing goes undiscovered?

This is also a critical document for the person named in your financial Power of Attorney. If you are ever incapacitated or unable to handle your own finances, your named representative needs to know the extent of your financial assets.

How do I get one?

The simplest option of course is to just write down everything that you own and keep it in a safe place.

At LegalWills.ca we provide a simple PDF form that can be downloaded from within our MyWill service. There is no charge for this document and it provides a framework for documenting not only your financial assets, but also your digital assets and online accounts, and also allows you to provide contact information for important people.

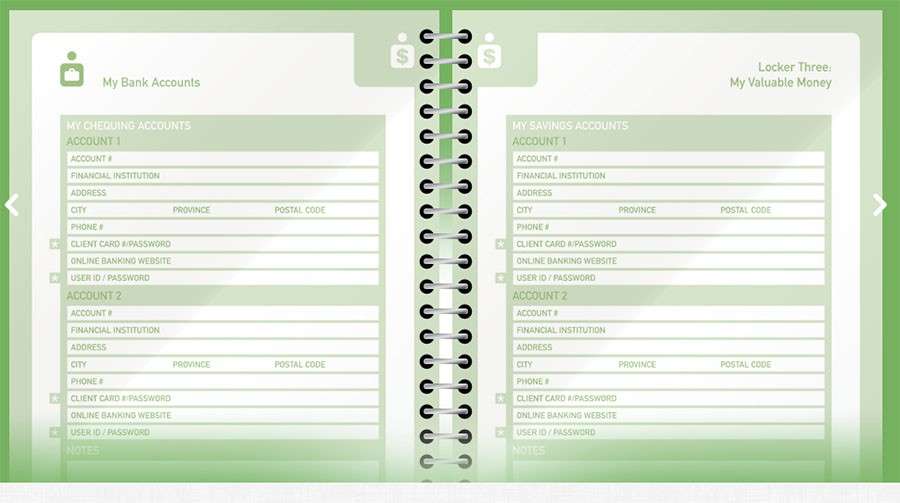

There are also a number of online services that provide this type of asset inventory. At LegalWills.ca we created the MyLifeLocker tool that does exactly this.

How much does it cost?

For a simple downloadable PDF or Word form, this type of template should be free of charge. There are some books available on Amazon that also provide this.

The MyLifeLocker service at LegalWills.ca costs $29.95, but uniquely it allows you to maintain this information all online. This means that it can be updated from your phone, tablet, or computer at any time from anywhere in the world.

Furthermore, you can name “Keyholders” who will be able to access the document after you have passed away.

What do I do with it once I’ve made it?

This document will be needed by your Executor, and by the person named as your financial Power of Attorney. It is not a legal document, and does not need to be signed or witnessed.

If you have taken the hard copy, piece of paper, approach to preparing this document, then it should be stored with your other estate planning documents; the Will and the financial Power of Attorney.

If you have used an online service like MyLifeLocker, then you should set up Keyholders to access the document when they need it.

An “ethical Will”

What is it?

Of all of these documents, this one is a “nice-to-have” and certainly not essential. An ethical Will is extremely popular in some cultures and defined on Wikipedia as “a document that passes ethical values from one generation to the next.”

“The content of an ethical will may be similar to that of a memoir or autobiography, but is differentiated by its “intention to transmit love and learning to future generations”. Writing can include family history and cultural and spiritual values; blessings and expressions of love for, pride in, hopes and dreams for children and grandchildren; life-lessons and wisdom of life experience; requests for forgiveness for regretted actions; the rationale for philanthropic and personal financial decisions; stories about meaningful objects for heirs to receive; and requests for ways to be remembered after death.”

How do I get one?

There are many ways to prepare an Ethical Will, and in it’s most simple form it is a letter to one’s children and loved ones.

There are online services that provide a framework for preparing an Ethical Will, and at LegalWills.ca we have created the MyMessages service to support this.

How much does it cost?

You should not pay for an Ethical Will template. The MyMessages service at LegalWills.ca is a free service.

What do I do with it once I’ve made it?

If you have written your messages on paper, then the document should be stored with your other estate planning documents. Perhaps they could be in a sealed envelope with a clear instruction on the front.

If you have used the MyMessages service at LegalWills.ca, then your messages will be delivered after you have passed away and once they are unlocked by your designated Keyholders.

Getting things done

This is a complete set of documents you should have in place, just in case something happens. We do live in a strange world. At the time of writing we know that COVID-19 is spreading. Even when it comes under control, these documents are important, and everybody should have them in place.

Every single one of these documents can be prepared online from the comfort of your home. No appointment is necessary, and no face-to-face meeting is required.

Please take a few minutes today to start the process of putting your documents in order.

- Probate in Canada – What it is, what it costs, how to reduce fees. - January 6, 2025

- All about Trusts – how to include a Trust in your Will - June 9, 2022

- The Holographic Will – what is it and when should you use one? - May 18, 2022